Business Funding Fast Secret Report

Congratulations – Here’s your insiders business funding secrets report!

“Finally! END The Business Struggles and Frustrations – Get Access To Private Never Before Publicly Released (*Nothing Held Back) Blueprint To Fast M.O.N.E.Y…”

Dear Friend,

What if you want working capital?

Hi I’m John.

Hi I’m John.

You’ve heard the saying…

You have to spend money to make money.

Following conventional wisdom it’s true.

You want to be able to take advantage of other people’s money (OPM)

Money to finance deals, projects and new opportunities:

- Growth

- Equipment

- Inventory

- Stock

- Hire staff

- Payroll

- Buyout

So the word on the street is you can’t grow unless you invest, right?

How can you invest in your business, while keeping money in your business for daily cash flow and operational costs?

What’s the fast, shortest, most efficient in time solution?

Would a small business loan make sense?

Risk of taking on debt can feel scary for small business owners…

Business loans can help finance a focused strategy in your business.

In turn that strategy can result in a higher return on your investment.

You tell me what do you really want?

You want FAST money, because it’s KEY to solving your problems.

Look, you understand the urgency to get your hands on money.

Money is exactly what insider to business funding secrets delivers…

Small businesses are discovering a new era in financial services.

And small business owners fed up are shunning the BIG banks.

They’re turning in droves to fintech lending alternatives.

This special report can literally get you funds in 10 minutes or less.

Yes, I’m not joking.

Carefully read every word and bypass bank loan business funding struggles…

The good new is we can FIX this problem for you right now.

I know you’re serious about your success because you are here…

Now it’s your turn, time to reach out and grab it with both hands.

You know no one faces more daily challenges than business owners.

What if you’re fed up feeling frustrated and disappointed?

In fact, you want revenue based financing, cash flow loans.

And working capital solutions to boost your business right?

You can tell the BIG banks it’s your way or the highway…

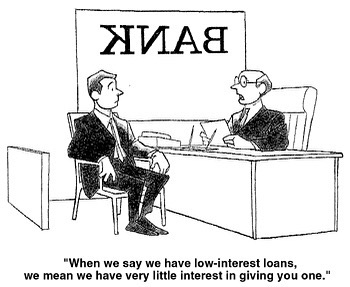

Small business loans from banks are a nightmare!

Yes! There are non-bank business loan alternatives.

In fact, we use them daily to help clients grow their businesses fast.

It takes about 10 minutes to read through this entire special report.

👉 Click here if you’re ready for business funding and want to get started right now…

On a personal note, I want to help you avoid the fate of the majority of small business owners.

You probably know why Business-Ad-Ventures is all about helping small businesses right?

Business funding these days has become a strategic game of chess.

For many it is a cut throat, daunting and overwhelming experience.

I can understand why the majority of small business owners are very skeptical about applying for bank loans.

Unfortunately the skepticism runs deeper for alternative finance.

What if you’re open minded, it will definitely help you to get FAST funding in this new technology based era…

In fact, stick with me here.

Because you can understand the process a lot better.

Leapfrog ahead of your competitors and keep moving forwards.

This valuable report will educate and arme you ready to take action.

Rest assured you can see how easy it is to apply for funding in 10 minutes or less with complete confidence.

You see, almost all business owners think if they have bad credit or no collateral…

There’s no chance for them getting a business loan.

True or False?

In reality, there are actually many different financing options business owners can qualify…

And even if they have bad credit challenges or don’t have collateral.

As you already know, banks REQUIRE good credit AND collateral to get approved for business financing.

Still most people only go to their bank when they need money,because it’s the only place they know to go to right?

Look the most common business bank loan only account for 1.1% of all business loans.

The reality is the big banks are NOT the only suppliers of most business loans…

And even though they require good credit and collateral to qualify, many other lenders don’t.

You see, the BIG banks are very conservative as you already know.

Now because banks commonly won’t lend to businesses where business owner has bad credit or don’t have collateral.

Listen businesses can succeed even if the owner doesn’t have perfect credit score…

And doesn’t have assets which can be pledged as collateral.

In fact, many business loans make really good sense with low risk based on other factors.

Even if the owner doesn’t have good credit and lacks collateral.

So what types of funding can and can’t you get with credit issues or if you lack collateral?

Before you know where to go to get money if you have credit problems…

You first should know where NOT to go.

These sources might be appealing based on their offers and promotions…

And they will not typically lend money to you if you have challenged personal credit.

Here’s just a short list:

- SBA loans

- Conventional bank financing

- Private investor money

All have stringent credit requirements.

Where NOT to Get Financing with Bad Credit or No Collateral…

SBA and other bank conventional loans are tough to qualify for because lender and SBA evaluates ALL aspects of business.

And the business owner for approval.

To get approved all aspects of business and business owner’s personal finances must be near PERFECT.

There is no question SBA loans are tough to qualify for evn at the best of times.

And this is why according to the Small Business Lending Index…

Over 89% of business applications are denied by the big banks.

Many people think when they’ve bad credit or lack collateral a private investor is their best answer…

In reality investors typically want average or better credit of 650 scores or higher in most cases.

And they almost always want you to pledge some type of collateral.

They will also want solid financials for at least two years.

And this means they’ll want to see tax returns showing large net profits that are increasing over time.

Think of private money as being for SBA and conventional bank loans…

You guess right because it just missed the mark.

“Unsecured” means no collateral is required for approval.

No collateral GREATLY increases a lender’s risk.

No collateral requirements usually means it’s quality of credit which determines qualification.

Any type of financing which has no collateral requirements…

AND no cash flow requirements requires good credit to qualify.

Where TO Go to Get Financing with Bad Credit or No Collateral…

- Revenue based financing

- Asset based financing

- Equity financing

- Crowdfunding

- Business credit

- Unsecured financing (via credit partner/personal guarantor)

These are all great funding options for any business owner or entrepreneur with personal credit issues or no collateral.

The truth is, there is a LOT of capital out there business owners can get…

And even with personal credit issues or no collateral.

Most of it isn’t available through big banks…

The great news is you can qualify for this massive amount of available financing based on your business strengths.

Yes, as long as your business has even one strength.

The big banks require your ENTIRE business and you to be near perfect to get money…

Now as you’re about to discover…

There are a lot of other financial sources which lend you money.

Even lots of money based just on one strength.

So as long as you have a strength to offset your weakness of bad credit or lacking collateral…

It is possible you can be approved.

This is often called compensating factors.

Cash-flow Based Financing…

Many businesses already have proven “concept” and consistently increasing sales.

Their strength is they have shown stability and they can effectively run a growing business.

The risk to lender is less as they are established businesses and are growing.

How are your sales?

Sales are the difference between untested concept or idea and a real operating business.

Will your idea be well received?

Do YOU know how to run a business?

Your sales can answer these questions…

And if you have consistent sales.

The next question is does your business have existing cash flow proven by bank statements?

There are lending options available only requiring a quick bank statement review for approval.

They won’t even need to look at your tax returns…

Even if your business shows a loss you’ll still be okay.

The next question is does your business have sales over $60,000 annually received in credit card sales?

Does your business have over $120,000 annually going through their bank account?

If the answer is yes then revenue financing or merchant advances might be the perfect funding product.

You see, for this type of “cash flow” based financing you must be in business six months.

No startup businesses can qualify…

You should have at least 10 monthly deposits or more going through your bank account, not just a few larger deposits.

Most advertising you see for “bad credit business financing” are these products.

These are short term “advances” of 6-18 months.

Mostly short term at first for 3-6 month terms.

So when half is paid down lender will lend more money at a longer term, such as 1218 months.

Loan amounts typically go up to $500,000…

Your actual loan amount is based on your revenue.

This is usually so you can get 8-12% of annual revenue.

Based on your verifiable revenue per your bank statements.

For example…

A company has $300,000 in sales might get a $30,000 advance initially.

The revenue and merchant financing 500 credit scores accepted and are COMMON with this type of lending.

Bad credit is okay as long as you aren’t actively in trouble such as in a bankruptcy…

Or there are no serious recent and unresolved tax liens or judgments.

For this type of cash flow based financing rates of 10-45% are common depending on risk.

Risk factors include:

- Type of industry

- Time in business

- Bank statement details (number of deposits, average daily balance)

- Non-sufficient funds (NSF charges)

- Amount of deposits monthly

- Credit quality

Usually rates are higher on first advance until you “prove” yourself to lender.

No tax returns are required, no other income docs are required…

And no collateral is required.

You won’t need to pledge any collateral to get approved.

Although you’ll typically be required to supply a personal guarantee.

This is required for almost all business financing which isn’t accompanied by collateral.

Asset Based Financing also called collateral based lending…

They lend you money based on the strength of your collateral.

If your collateral offsets lender’s risk, you can be approved with bad credit.

And still get REALLY good terms.

Common types of BUSINESS collateral might include:

- Account receivables

- Inventor

- Equipment

Account receivable financing you can secure up to 80% of receivables within 24 hours of approval.

You must be in business for at least one year and receivables must be from another business.

Rates are typically 1.25-5%.

You can also use your inventory as collateral for financing and secure inventory financing.

The minimum inventory loan amount is $150,000.

And general loan to value (cost) is 50%; inventory value would be $300,000 to qualify.

Rates are normally 2% monthly on outstanding loan balance.

Example for factory or retail store…

Based on equipment financing lenders undervalue equipment up to 50% and work with major equipment only.

Lender won’t combine a lot of small equipment…

The first and last month’s payments are required to close.

Loan amounts are available typically up to $2 million dollars.

Common PERSONAL collateral can qualify for collateral based lending might include SUPER and STOCKS…

SUPER or STOCKS can be used to get up to 100% financing and rates are usually less than 3%.

A retirement plan is created allowing for investment into the corporation.

Funds are rolled over into the new plan…

The new plan purchases stock in corporation and holds it.

The corporation is debt free and cash rich.

And securities based lines of credit you can get advance for up to 70-90% of the value of your stocks and bonds.

These work much the same as SUPER financing with similar terms and qualifications.

Equity Financing and Crowdfunding…

Equity financing you exchange a percentage of ownership in your business for financing.

This is similar to what happens on the TV show Shark Tank.

Personal credit is NOT an issue or will you need to provide collateral.

However, equity investors are looking for a tested.

And proven concept and sales really help approval.

You might find some investors to invest in a concept only, or invention.

Most will want to see you have an operating business earning money and making profits.

And expect they’re going to want a large piece of equity.

Yes for a business loan to be worth their time to invest…

They can ask for 10-60% ownership of your business.

This means they’ll be taking a large part of your future earnings.

It is something you want to consider before recruiting an investor.

There are lots of websites to get crowdfunding for your business…

This type of funding gets money from a “crowd” or a lot of people instead of one big investor.

If the crowd likes your idea they may donate money to your project.

Much of crowdfunding doesn’t need to be paid back and many investors are people you know.

If you really look into crowdfunding you’ll find there are all types available.

Some types of crowdfunding want a certain percentage of return…

And some want a percent of equity ownership.

There are different sources and platforms for different needs.

And even unique niches or industries.

So make sure you find the right crowdfunding platform for you before you post a project.

Business Credit and Unsecured Credit…

Business credit is a great way to get money.

Approvals are not based on personal credit and no collateral is required for approval.

Business credit reports usually get started with a few vendor accounts who will initially offer credit.

Initial accounts create tradelines and a credit profile and score are established.

The company’s new profile and score are used to get credit.

New credit is based on company’s credit per Tax ID, not owner’s credit based on TFN…

Personal credit doesn’t matter as credit linked to Tax ID is used for approval.

When you use vendors to build your initial credit…

You can leave your tax file number (TFN) off the application.

And can apply for business credit based solely on your Tax ID at most retail stores.

Plus, you can get cash credit.

Also get access to high-limit cards with MasterCard and Visa…

Building business credit all starts with vendor accounts.

You see, you won’t be able to start your credit profile initially.

And profile being established is key to getting cash and store credit cards for your business.

This is once you find vendors you want to apply for!

Apply and use your credit…

It takes about 1-3 months for those accounts to report to business bureaus.

Once those accounts are reported a business credit profile and score are established.

And this can be used for you to get store credit cards next.

Once you have about 10 payment experiences reporting…

You can start to get cash credit like Visa and MasterCard accounts.

A payment experience is the reporting of an account to one business bureau.

So if an account reports to two bureaus…

It would actually count as two payment experiences.

You can get approved for vendor accounts right away that offer credit on Net 30 terms.

Once you use those accounts they are reported which takes about 30-90 days.

At that point, only 90 days or less you can use newly established credit to get high-limit store credit cards.

In about 30-90 days longer you can be approved for $5,000-10,000 limit cash credit cards.

And you can use almost anywhere…

Now because the fast building and approval time…

Business credit makes a lot of sense for credit challenged business owners and entrepreneurs.

Unsecured credit requires no collateral, yet DOES require good credit…

If you have credit issues you can still get approved.

If you have a good credit partner…

Maybe someone who will sign as guarantor who does have good credit.

The guarantor is then liable for business debt in case that account defaults.

Approval amounts range from $10,000 to $150,000.

Card limits are equal to what guarantor has on their credit now.

These accounts do report to the business bureaus in most cases…

So they also help build your business credit and they are NOT reported on the guarantor’s personal credit report.

Your guarantor will need excellent personal credit to qualify.

👉 Click here for financing options to help with cash flow and get money for your business…FAST!

Summary…

Over the years, we’ve seen an overwhelming number of business owners using the internet to research their important funding issues.

Many are stumbling into “bank loan traps”…

This guide is intended to give you deeper insights on how business funding works.

For example…

What amount you borrow and how it exposes or affects your short and long-term cash flow.

Right now the choice for business owners and entrepreneurs…

There are actually A LOT of different viable financing options.

Even if you have bad credit, low credit score or lack collateral.

The key is to know where NOT to look.

And not waste your time and money on costly mistakes.

YES! You want to know where to FOCUS your time and energy…

Places which will approve your loan based on your strengths right?

If you do have personal or business collateral as we discussed…

You probably qualify for higher financing over $250,000 right now.

If you have cash flow of $5,000 monthly.

👉 Yes, if you qualify for cash-flow based financing click here to get started…

If you have a partner or other party who will sign as a guarantor.

You have yet another good funding option available with unsecured financing.

And even if you have no collateral, cash flow, guarantor and bad credit…

Business credit is still an easy and fast way to get your hands on money.

We trust this helps you get one step closer to getting money you want to grow your business.

👉 Click here for financing options to help with cash flow and get money for your business…FAST!

Ultimately you want #1 trusted lender which is transparent.

You want to know exactly what payments are before taking out loan.

That way you’re never unfairly charged.

And you don’t pay for any sneaky hidden fees, ever.

How much would you expect a loan to cost?

Here’s how to keep pricing simple.

There’s the loan repayment and interest rate…

You want rates between 0.75% to 2% per fortnight on your outstanding balance.

What are the extra fees?

Obviously, you don’t want to be charged any hidden fees at all right?

Other lenders will often advertise certain rates, still they’ll catch you out with hidden fees.

What fees and charges should I look out for from lenders?

Application fee: Similar to establishment fee, many lenders charge application fee.

And this fee is payable even if your loan application is declined.

You don’t want to be charged for application fee right?

Direct debit fees: Some lenders charge you a few dollars every time you make a repayment.

Although this may only seem like a small charge…

$3 direct debit fee can turn into hundreds or even thousands of dollars.

Do the math on repayments which are weekly or daily.

You don’t want to be charged for any direct debit fees at all right?

Establishment fees (also known as origination fees): This is sometimes a standard flat fee.

However, more often than not is calculated as a percentage of total loan amount.

Want zero establishment fee?

Early repayment fees: If you’re ready to pay off your loan early, more power to you!

Many lenders require you to pay a penalty for early repayment or charge interest on all remaining loan amount.

Always read your loan agreement carefully and know what the terms are if you want to pay out early.

*The Fine Print: Get access to lowest rates at 0.75% per fortnight.

Other rates may apply based on assessment of your business during loan application process.

👉 Click here for financing options to help with cash flow and get money for your business...FAST!

If you’ve questions, feel free to contact support via email: support@business-ad-ventures.com

Business Funding Fast Secrets

3 Easy Steps To FAST Business Funding Success™

Copyright 2018 Business-Ad-Ventures.com